If you have been looking into budgeting options, I’m sure you have found a few articles about envelope budgeting. I have given a breakdown of this budget in the article here. Even though this budget method is primarily cash, there is an electronic version for those who dislike dealing with the cash system. I used EveryDollar when transitioning into the cash system and was not ready to go cash entirely, and I loved that option. Using an envelope system wallet, I make a hybrid approach of cash-in envelopes for fluctuating spending like nails, food, and coffee. Here is a link to the option I currently use. I also use an electronic budget system for my bills using Mint and EveryDollar and a spreadsheet I put together for personal and family needs.

Suppose you need to familiarize yourself with the electronic envelope budget system. In that case, it’s a virtual envelopes budgeting technique that allows you to divide your money into various categories and track your spending for each type. The concept is like using physical envelopes to hold cash for different expenses, but with virtual envelopes. You use an app or software to distribute money and track your spending.

To use virtual envelopes, you typically start by creating a budget and dividing your income into categories: housing, food, transportation, entertainment, and savings. You then distribute a certain amount of money to each type and use a real-time budgeting app or software to track your spending.

As you spend money on various categories, the app or software deducts the amount from the envelope, visually representing how much you have left for each type. This can help you stay on track with your budget and avoid overspending.

Overall, virtual envelopes can be a powerful tool to help you manage your money and achieve your financial goals. Tracking your spending and staying within your budget can save money, reduce stress, and improve your financial situation.

In this article, I will review a few options for iPhone users, including EveryDollar, which I currently use. Here are a few options to consider:

- EveryDollar: EveryDollar is another app that uses the envelope budgeting system using Dave Ramsey’s favorite method, zero-dollar budgeting. You can create virtual envelopes for different expenses and track your spending. You can also create a monthly budget, connect your accounts, and get insights on your spending totals, income, and spending breakdown.

- GoodBudget: GoodBudget is a popular envelope budgeting app that allows you to set up virtual envelopes for various categories of expenses. You can track your spending and see how much money you have left in each envelope. The app also allows you to synchronize your budget with other devices and share it with others.

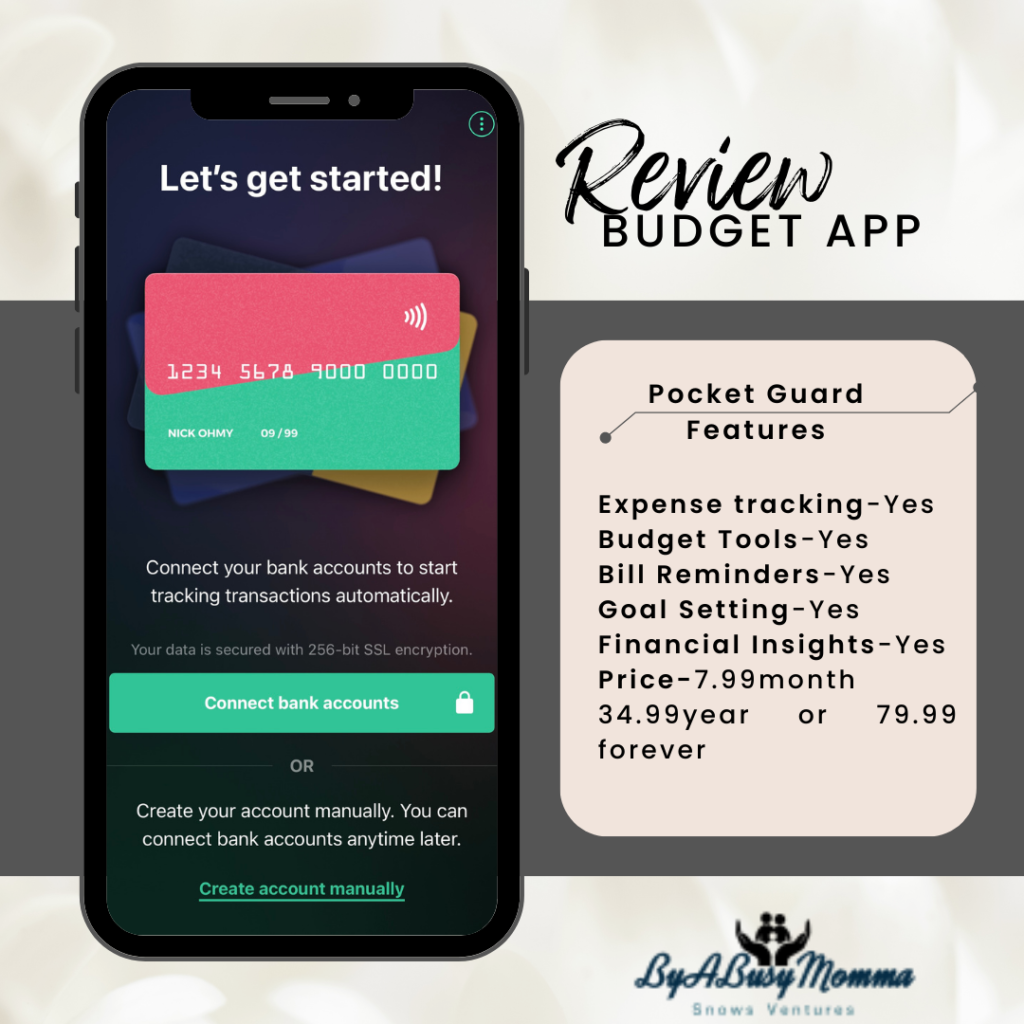

- PocketGuard: PocketGuard is a budgeting app that uses a different approach to managing your finances. Instead of virtual envelopes, the app uses an “in your pocket” feature that shows you how much money you can spend after accounting for bills and savings goals. The app also offers spending tracking and alerts for bills and fees.

- Simplifi: Simplifi is a budgeting app that offers a range of tools to help you manage your money, including envelope budgeting. You can set up virtual envelopes for different expenses and track your spending in real time. The app also offers bill tracking, alerts, and personalized insights.

- YNAB: YNAB (You Need a Budget) is a popular budgeting app that offers envelope budgeting and other tools to help you manage your money. The app allows you to set up virtual envelopes for different expenses and track your spending in real time. It also offers personalized insights, goal setting, and bill tracking.

These are just a few envelope budgeting apps available for iPhone users. When selecting an app, consider your specific budgeting needs and preferences, as well as the features and pricing of each app. As you may already be aware, a budgeting app is a mobile application that helps you manage your finances by tracking your income and expenses. Budgeting apps can be a valuable tool for anyone looking to improve their financial situation, set financial goals, and gain control over their spending.

Some standard features of budgeting apps that you should look for when considering which app you should be using include the following:

- Expense tracking: Budgeting apps allow you to track your expenses in real-time, categorize them by type, and view reports to see where your money is going.

- Budgeting tools: Many budgeting apps help you create and manage a budget. Some apps use the envelope budgeting system, where you distribute money to different categories of expenses to help you stay on track.

- Bill reminders: Budgeting apps can send reminders when bills are due, helping you avoid late fees and missed payments.

- Goal setting: Some budgeting apps allow you to set financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund.

- Financial insights: Many budgeting apps offer personalized insights and recommendations to help you improve your financial situation.

Many different budgeting apps are available, each with unique features and benefits. Some other popular options not listed above include Mint (though this is not an envelope budgeting system, it is still a great budgeting tool I am currently using) and Personal Capital.

Budgeting apps can be a powerful tool to help you manage your money and achieve your financial goals. You can improve your financial situation and gain peace of mind by tracking your expenses, creating a budget, and staying on top of your bills, all from the comfort of your phone without handling cash if you are not a cash person.