About two years ago, when I found out I was pregnant with my first child, I scoured the internet for information about baby care and other child-related questions. My sister, who just had her first baby then, mentioned that I should check out BabyCenter to get great information on my baby’s progress and what to expect. I was using the app version when I first learned about the website, and I loved it. I have since found that this online source is super valuable for first-time moms. It’s a good resource for tracking your baby’s development stages; however, this article will review the advice on money and family financial needs.

Babycenter.com has multiple articles and tools that are good family financial resources for parents just starting on the journey of parenthood. One of their most effective tools for calculating the family’s financial needs for a new baby is their cost calculator, which has an all-inclusive expense list of requirements for a new baby.

Even though the cost calculator on the BabyCenter website is the most valuable tool, they also have some excellent articles that relate to family finances, which I will review in short form in this article. Each post is referenced below with a quick summary and takeaways for quick reference.

Article Review 1: “How to financially prepare for a baby: Tips for new parents.”

A family budget involves evaluating your expenses and income while considering an extra human to feed, clothe and clean.

S. Penariu

Article summary: Babies significantly impact family finances; therefore, planning for the expense is wise for a new parent. Some suggestions in this article include creating a budget, figuring out your health coverage, buying life and disability insurance, a college saving plan, childcare, tax credits, and how to stick to a budget.

Evaluation: One of the most valuable takeaways in this article is that as a new parent, you should be aware of your child’s new standing regarding your family tax filing. They will have their Social Security Number in all future tax filings, and they are your dependents, so you will receive tax credits. It is an excellent thing to remember when evaluating your new financial needs as a parent.

Another important takeaway from this article is that creating a family budget is essential as you transition into having a family and not just managing your finances individually or as a couple. A family budget involves evaluating your expenses and income while considering an extra human to feed, clothe and clean. If you are considering childcare, also be aware that you must include this expense in your new budget.

Article Review #2 – How much does a baby cost per month?)

A key takeaway is that the highest expense will be childbirth, so ensure you have a financial plan for what your insurance will not cover

S. Penariu

Article Summary: This article details the costs of having a baby, from the average yearly price in the US to the cost of childbirth, healthcare, formula, diapers, childcare, baby gear, baby clothes, and baby food, as well as the cost of baby toys and books.

Evaluation: I remember reading this article and thinking, ” Oh my goodness, this child will cost me a fortune! ” But honestly, they don’t cost as much in the first year as I anticipated. Because if you throw a baby shower and have some fantastic grandparents, your friends, and family take care of the child’s basic needs of clothes, baby gear, toys, and even diapers. However, this article was helpful when it comes to evaluating what to expect when it comes to child costs. My baby was breast milk and formula fed, and I agree that the cost of formula and diapers was my highest expense in that first year of her life.

A key takeaway is that the highest expense will be childbirth, so ensure you have a financial plan for what your insurance will not cover. With all the costs of a cesarean birth covered by my insurance, I was still paying about 5K out of pocket for the delivery. These expenses are essential to plan for as much as planning the monthly costs of diapers, formula, and clothes.

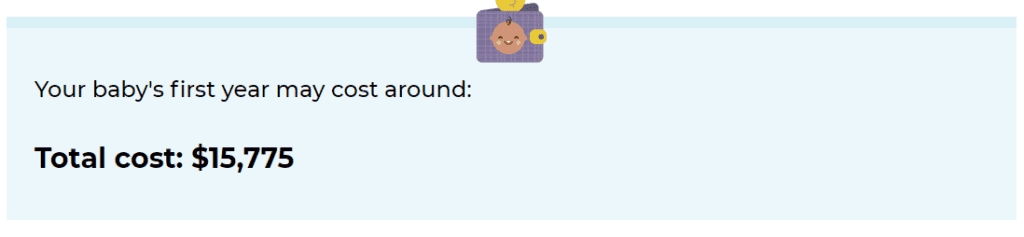

Article Review #3 – Everyday expenses for a baby’s first year now exceed $15,000 thanks to inflation

Article Summary: This is an updated article on the costs of a baby with the new price increase due to inflation. They include a list of essential baby needs for the first year and how much a parent should expect to pay. The cost averages to about 1,300 monthly on baby expenses only. Knowing that the price is so high can cause a lot of stress for a new family. Based on the article, about 25% of parents have decided to have fewer children because of the rise of inflation. Also, 73% have stated that they are making significant financial sacrifices to prepare for the coming of their new family addition.

Evaluation: I’m an optimist, and of course, my first reaction to these staggering numbers is to say a parent will figure it out, but the realist side of me (mostly comes from my husband) is saying that these numbers are something that a parent needs to consider when having a child. Children are a blessing! I love having my baby girl, but understanding a child’s financial needs is important for parents to consider. Being prepared for the cost and having a plan is much better than feeling blindsided. Getting creative on how much you spend will also help. One of the best hacks for cutting costs for a child is looking at free options for clothes, child equipment, and other baby needs. If you have family members who have children that have grown out of clothes, request to get some hand-me-downs, or if they have slightly used baby equipment, don’t be shy to ask to borrow or take over the equipment to save a few dollars. In short, when it comes to having a child knowing the cost is essential, but even more important is looking into creative ways to make the dollars stretch farter.

Some good reference tools I found on BabyCenter.com are the Money Articles, which list some of the articles I have reviewed above. The First Year Baby Cost calculator is a brilliant way of evaluating how much you can anticipate spending on your little human in the first year. My husband and I used this calculator when we first found out we were pregnant to estimate how much we would need to add to our spending account for baby expenses.

In conclusion, the cost calculator is the most helpful tool that BabyCenter offers. Suppose you’re a new mom looking for a quick calculation of what to expect regarding your new baby’s costs. In that case, I highly recommend using BabyCenter’s “First-Year” Baby Cost Calculator to start making a “new” baby budget. I have included the link to the baby cost calculator and the Money articles pages here.

Baby costs calculator: How much does a baby cost? | BabyCenter

Please let me know if you want more reviews like this in the comment section below.