Family finance, a vast and significant topic, can be navigated with the transformative power of just seven books. A quick search on the web and popular booksellers like Barnes & Noble will reveal a list of highly reviewed and regarded family finance books. These books cover various topics related to managing personal finances and building wealth. In today’s complex financial landscape, a solid understanding of personal finance is crucial for building wealth, achieving economic stability, and securing a prosperous future for your family. Fortunately, several exceptional books offer valuable insights, practical strategies, and timeless wisdom on managing money. In this blog post, I will delve into the top seven finance books that can transform your relationship with money and set you on the path to financial success.

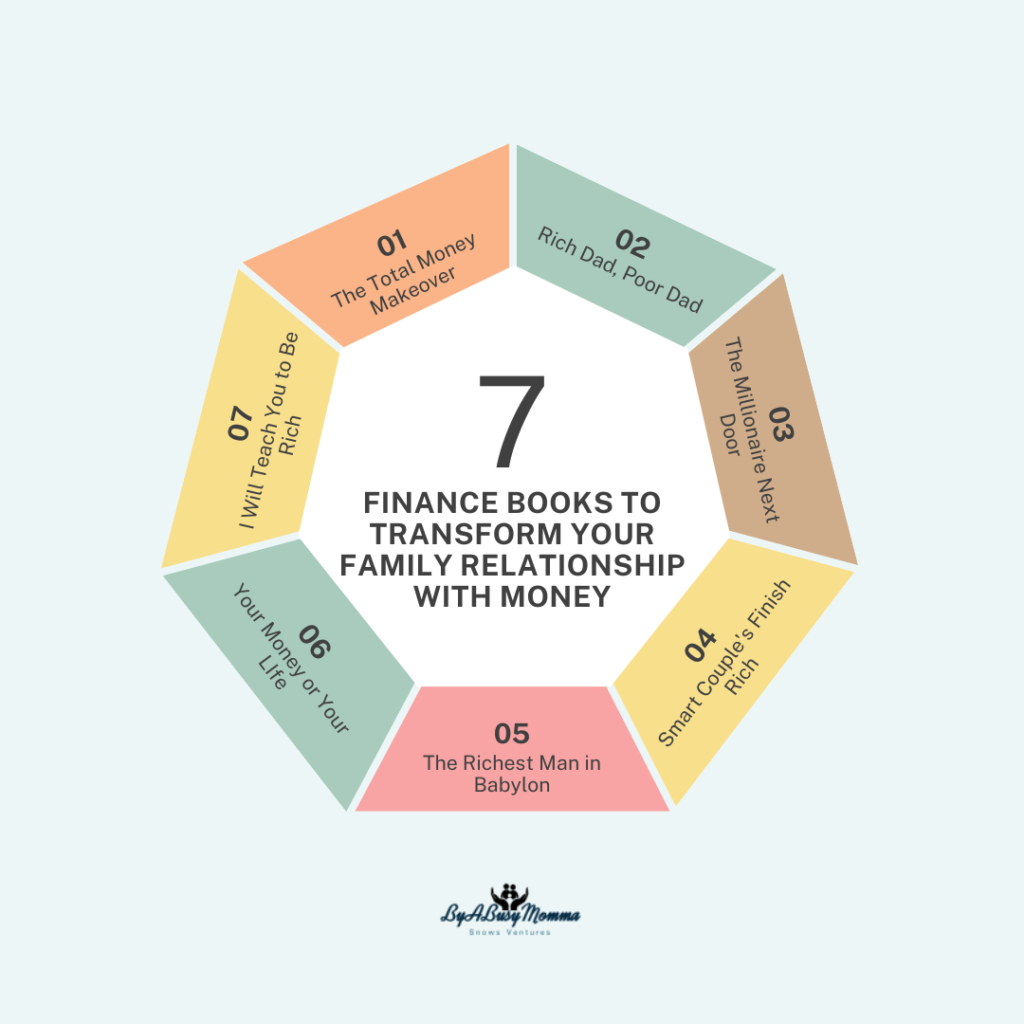

Below is a list of the top seven personal and family finance books.

1. “The Total Money Makeover” by Dave Ramsey: This book provides a step-by-step plan to get out of debt, save money, and build wealth. It emphasizes the importance of budgeting and living within your means. Dave Ramsey is a well-known personal finance expert, and this book outlines his popular seven-step plan for achieving financial freedom. It covers topics such as creating a budget, paying off debt, building an emergency fund, and investing for the future. The book emphasizes the importance of changing your money habits and adopting a disciplined approach to financial management. With a focus on budgeting, living within your means, and adopting a disciplined approach to financial management, this book provides a roadmap for achieving financial freedom.

2. “Rich Dad, Poor Dad” by Robert Kiyosaki: This book challenges conventional wisdom about money and advocates financial literacy. It explores the difference between working for money and having money work for you. This book presents a unique perspective on wealth and economic independence. Kiyosaki contrasts the experiences and mindsets of his two fathers—rich and poor—to highlight the importance of financial education and acquiring assets that generate passive income. It encourages readers to think differently about money and to strive to become investors rather than just employees.

3. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko: This book examines the habits and characteristics of America’s wealthy individuals. It offers insights into building wealth by living frugally, saving, and investing wisely. In this book, the authors challenge common perceptions of wealth and provide insights into the habits and behaviors of millionaires. They argue that many wealthy individuals are not the flashy spenders often portrayed in the media but ordinary people who live frugally, save diligently and make wise investment choices. The book offers practical advice on building wealth and avoiding common pitfalls.

4. “Smart Couples Finish Rich” by David Bach: Explicitly geared towards couples, this book provides strategies for managing money, building a financial plan together, and achieving financial security. It provides methods for couples to communicate effectively about money, set joint financial goals, and align their values and priorities. The book covers budgeting, saving, investing, and retirement planning to help couples achieve economic security and fulfillment together.

5. “The Richest Man in Babylon” by George S. Clason: Set in ancient Babylon, this book offers timeless financial lessons through parables. It covers topics such as saving, investing, and growing wealth. The lessons are presented engagingly, making it an accessible read for anyone interested in improving their financial situation.

6. “Your Money or Your Life” by Vicki Robin and Joe Dominguez: This book explores the relationship between money and life satisfaction. It provides a nine-step program for transforming your relationship with money and achieving financial independence. It encourages readers to examine their values, assess their financial position, and make conscious choices about spending and saving. The authors present a nine-step program for achieving economic independence and aligning financial decisions with life goals.

7. “I Will Teach You to Be Rich” by Ramit Sethi: This book is a practical guide to personal finance for young adults. It covers budgeting, saving, investing, and automating your finances. This book is written specifically for young adults and offers a practical and no-nonsense guide to personal finance. It covers budgeting, saving, investing, and optimizing your credit cards and bank accounts. Sethi provides actionable advice and strategies to help readers automate their finances, make informed decisions, and build wealth over time.

Each book offers valuable insights into managing personal finances and building long-term wealth. They provide different perspectives, strategies, and approaches to suit various financial goals and situations. The practical advice in these books can help you improve your financial knowledge, make informed decisions, and work towards achieving financial security and independence.

For someone just starting to learn about personal finance, I would highly recommend “I Will Teach You to Be Rich” by Ramit Sethi. This book is particularly well-suited for young adults and beginners because it provides a step-by-step guide to managing personal finances in a practical and relatable manner, addressing the specific needs of this audience.

“I Will Teach You to Be Rich” covers various personal finance topics, including budgeting, saving, investing, banking, and credit cards. It presents actionable advice and strategies that are easy to understand and implement. The book emphasizes the importance of automation and setting up systems to make managing money simpler and more efficient.

Ramit Sethi’s writing style is engaging and approachable, making the book accessible to readers who may be new to personal finance concepts. He also addresses common misconceptions and offers practical tips for negotiating better deals, increasing income, and achieving financial goals.

Overall, “I Will Teach You to Be Rich” provides a solid foundation in personal finance and offers valuable guidance for those just starting their financial journey. It can help readers develop good financial habits, gain confidence in managing their money, and set themselves up for long-term economic success.

Personal finance is a vast field; these books offer different perspectives and strategies. Reading multiple books and tailoring the advice to your specific circumstances and goals is always helpful.

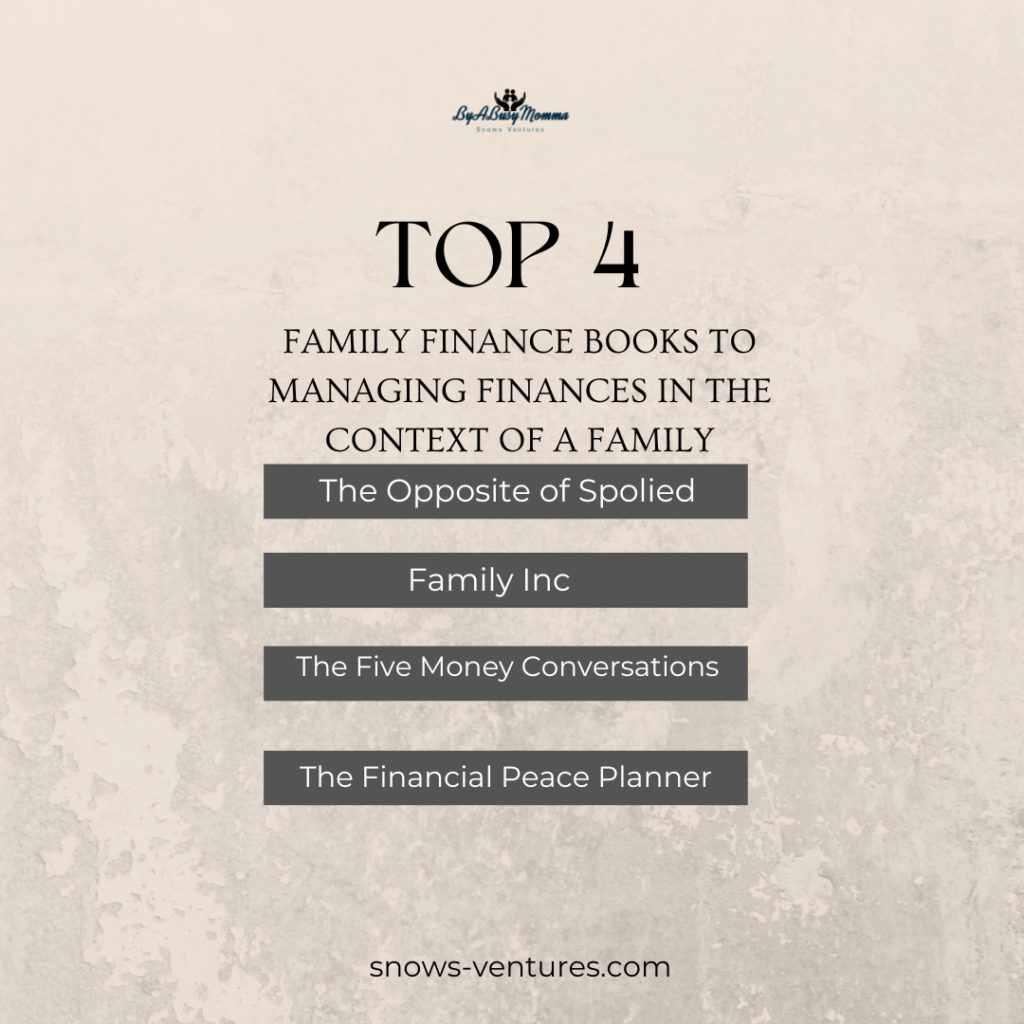

Here are some highly recommended family finance books that specifically focus on managing finances within the context of a family:

1. “The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money” by Ron Lieber: This book offers practical advice on how to teach children about money, instill good financial values, and raise financially responsible kids. It covers topics such as allowance, saving, spending, giving, and navigating the challenges of materialism and peer pressure. It provides practical advice on such topics as how to introduce the concept of money to children, teaching them about saving, spending, and giving, and navigating common challenges like materialism and peer pressure. The book offers insights and real-life examples to help parents raise financially responsible kids.

2.” Family Inc.: Using Business Principles to Maximize Your Family’s Wealth” by Douglas P. McCormick: This book applies business and financial principles to managing family finances. It provides a framework for making strategic income, expenses, investments, and long-term wealth accumulation decisions. It also offers guidance on insurance, estate planning, and raising financially responsible children. It encourages families to approach financial affairs strategically, incorporating concepts such as cash flow management, balance sheets, and investment strategies. The book guides income optimization, expense management, investing, and long-term wealth accumulation. It also explores the importance of aligning financial decisions with family values and goals.

3. “The Five Money Conversations to Have with Your Kids at Every Age and Stage” by Scott and Bethany Palmer: This book offers a roadmap for having money conversations with children at different stages of their lives. It provides insights and practical tips for discussing topics such as saving, spending, giving, debt, and financial responsibilities, tailored to the specific age and maturity of the child. This book provides a framework for having age-appropriate money conversations with children. It covers five critical conversations parents should have with their kids at different stages of their lives, from preschool to young adulthood. The book offers practical tips, strategies, and conversation starters for discussing saving, spending, giving, debt, and financial responsibilities. It aims to equip parents with the tools to raise financially literate children.

4. “The Financial Peace Planner: A Step-by-Step Guide to Restoring Your Family’s Financial Health” by Dave Ramsey: Written by renowned personal finance expert Dave Ramsey, this book provides a comprehensive plan for families to achieve financial stability and security. It covers budgeting, debt reduction, saving, investing, insurance, and planning for significant life events like college and retirement. It covers essential topics such as budgeting, debt reduction, emergency funds, insurance, investing, and retirement planning. The book offers practical worksheets, checklists, and strategies to help families manage their finances and work towards long-term financial goals.

These books offer valuable guidance and strategies for managing family finances, teaching children about money, and building long-term wealth as a family unit. Each book provides unique insights and actionable advice to help families navigate their financial journey together.

These family finance books provide a range of insights and strategies for managing finances within the context of a family. They offer practical advice, real-life examples, and actionable steps to help families raise financially responsible children, make informed financial decisions, and work toward long-term financial security and success together.

Incorporating the insights and strategies from these top finance books into your life can profoundly impact your financial well-being. Whether you want to get out of debt, build wealth, or raise financially responsible children, these books offer knowledge and practical advice. By reading and applying the principles outlined in these books, you can transform your relationship with money, make informed financial decisions, and pave the way for a prosperous future. Start exploring these finance books today and take a significant step towards economic empowerment.