Before looking at the top nine software options on the web, let’s break down what family finance software includes. Family finance software is computer programs or phone applications designed to help families manage their household finances. These software solutions typically provide tools and features to track income, expenses, budgets, savings, and investments. They aim to streamline financial management, improve budgeting, and provide insights into financial health.

Family finance software can monitor and control spending, set financial goals, track bills and payments, and generate reports for analysis. Some software options offer features like investment tracking, retirement planning, and tax preparation. These software solutions can be desktop-based, web-based, or mobile apps, allowing users to access and manage their finances from various devices. They often provide synchronization capabilities to connect with bank accounts and credit cards, automatically importing transactions to provide accurate and up-to-date financial information.

Also, check out the following budgeting tools on Amazon:

- Deluxe Executive Envelope System- Dave Ramsey

- Household Ledger: For Budget and Finances

- The Total Money Makeover: A Proven Plan for Financial Fitness

- Budgeting Money Organizer for Cash Money Envelopes

In other words, getting an excellent family finance software tool is a great life hack for busy moms who want a single go-to location for all their family financial needs. Family finance software can be beneficial for several reasons, and here is a short list of some of these benefits:

- Budgeting and Expense Tracking: Family finance software helps you create and maintain a budget by tracking your income and expenses. It provides a clear overview of where your money is going, helping you identify areas where you can cut back or allocate funds more effectively. You can gain insights into spending patterns and make informed financial decisions by tracking expenses in detail.

- Financial Goal Setting: Family finance software allows you to set financial goals, such as saving for a down payment on a house, planning a vacation, or building an emergency fund. It helps you track your progress towards these goals, providing motivation and accountability. With goal-setting features, you can establish a roadmap for achieving your family’s financial aspirations.

- Monitoring Cash Flow: Managing cash flow is crucial for maintaining financial stability. Family finance software allows you to monitor your income and expenses in real-time, helping you understand how much money is coming in and going out. This knowledge enables you to make informed decisions about spending, saving, and investing, ensuring you maintain positive cash flow.

- Debt Management: Many families have debts, such as mortgages, student loans, or credit card debt. Family finance software can help you track and manage your debt by providing tools to organize and prioritize repayment. It lets you see your outstanding balances, interest rates, and payment schedules, helping you develop strategies to reduce and eliminate debt.

- Financial Organization and Record-Keeping: Family finance software helps you keep all your financial information and records in one secure place. It eliminates manual record-keeping and reduces the risk of losing critical financial documents. You can store and access information about bank accounts, investments, bills, and receipts, making tracking and managing your financial affairs easier.

- Collaboration and Transparency: Family finance software allows multiple family members to access and contribute to financial management. This promotes transparency and cooperation in decision-making. Communicating and working together towards shared financial goals becomes easier, ensuring everyone is on the same page.

- Financial Analysis and Reporting: Family finance software often provides reporting and analysis features, generating insights into your financial health. You can view charts and reports that help you understand your spending habits, savings rate, net worth, and investment performance. This data-driven approach enables you to make informed decisions and adjustments to improve your financial situation.

Overall, family finance software simplifies household finances, provides better visibility and control over your financial situation, and supports you in achieving your financial goals. It saves time, reduces stress, and empowers you to make more informed decisions about your family’s economic well-being.

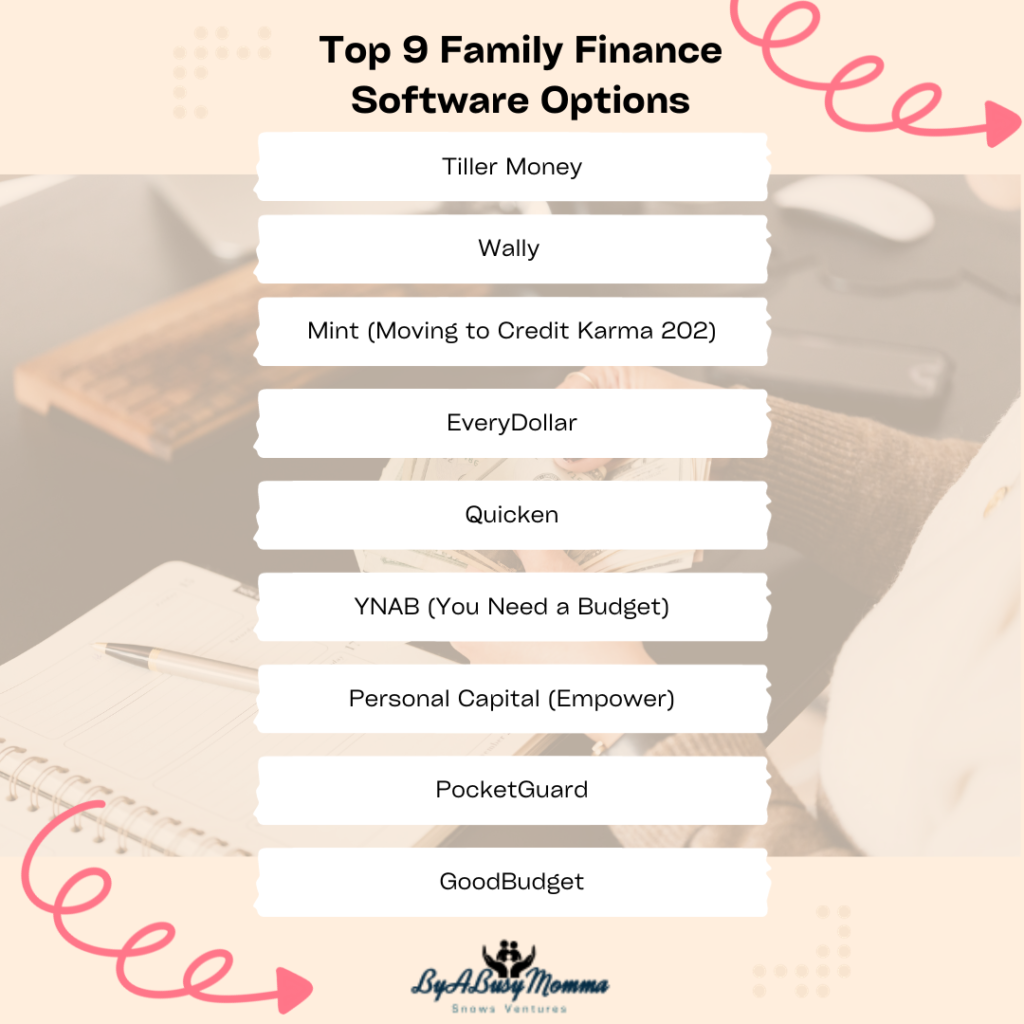

As seen above, having an excellent finance software tool can help streamline a lot of the difficulty of budgeting, investing, and managing everyday banking transactions for moms on the go. There are various family finance software options available that can help you manage your household finances effectively. Here are nine popular choices:

- Mint (moving to Credit Karma 2024): Mint is a free web-based mobile app that tracks and manages your finances in one place. It provides budgeting tools, expense tracking, bill payment reminders, and insights into your spending habits. Mint is a widely used and free personal finance software. It automatically categorizes your transactions, tracks your spending, and allows you to set budgeting goals. Mint also provides personalized money-saving tips based on your spending patterns and offers credit score monitoring. I have used Mint for many years, and it has been my favorite money management tool; however, they are transitioning to a new provider, Credit Karma. I am unsure if I will remain with them after the transition.

- EveryDollar: EveryDollar is a budgeting app created by Dave Ramsey, a well-known personal finance expert. It follows the zero-based budgeting method, allocating every dollar of income to different categories or “budget items.” EveryDollar helps you track your expenses and provides insights into your spending habits. Since Mint is transitioning to Credit Karma starting in January 2024, I have moved my budget software to EveryDollar. There are some great features with this software that I do apply, but it has been a significant adjustment for me since I have used Mint for years and have a lot of transactional history in it.

- Quicken: Quicken is a comprehensive personal finance software that offers features such as budgeting, bill management, investment tracking, and tax preparation. It allows you to sync your financial accounts, track your income and expenses, and generate reports to gain insights into your financial health. Quicken offers different versions, including Starter, Deluxe, and Premier, catering to different needs.

- YNAB (You Need a Budget): YNAB is a popular budgeting software that focuses on helping users create and stick to a budget. It provides goal-setting and expense-tracking tools and educational resources to help users improve their financial management skills. It focuses on assigning every dollar a job and encourages users to create and stick to a budget. YNAB offers features like expense tracking, goal setting, and educational resources to help users improve their financial habits.

- Personal Capital (Empower): Personal Capital (Empower) is a financial management platform that combines budgeting, investment tracking, and retirement planning tools. It offers a comprehensive overview of your financial picture and provides insights into your investment performance. It offers tools to analyze your investment portfolio, monitor your net worth, and plan for retirement. Personal Capital also provides a personalized financial advisor service for a fee.

- PocketGuard: PocketGuard is a mobile app focusing on budgeting and tracking expenses. It connects to your financial accounts, categorizes your payments, and helps you set spending limits. It also provides insights into your cash flow and alerts you of potential overspending. PocketGuard sets spending limits based on your income and bills and sends alerts to help you stay on track.

- Tiller Money: Tiller Money is a spreadsheet-based financial management tool that allows you to customize your budgeting and expense tracking. It automatically imports your financial transactions into Google Sheets or Microsoft Excel, making it highly flexible and customizable. Tiller Money provides flexibility and control in managing your financial data.

- Goodbudget: Goodbudget is a digital envelope budgeting system that helps you allocate your income into different virtual “envelopes” for various spending categories. It promotes the cash-based budgeting method, where you spend according to the money available in each envelope. Goodbudget offers syncing across multiple devices, making it convenient for families to collaborate on budgeting.

- Wally: Wally is a mobile app focusing on tracking and budgeting expenses. It allows you to manually enter your expenses or scan receipts, categorize your spending, and set savings goals. It also provides insights into your spending patterns. It allows you to manually enter your expenses or scan receipts, categorize your spending, and set savings goals. Wally gives a clear overview of your financial transactions and offers insights into your spending patterns.

Consider your specific needs and preferences when choosing a family finance software. Some software may offer more comprehensive features, while others may focus on particular aspects like budgeting or investment tracking. Finding a tool that aligns with your financial goals and helps you effectively manage your family’s finances is essential. When choosing a family finance software, consider factors such as platform compatibility (web-based, mobile app, or both), ease of use, security measures, customer support, and any additional features that may be important to you and your family’s financial management needs.