If you have looked into budgeting, the struggle of figuring out what will work for my family has most likely crossed your mind. The main issue with budgeting is figuring out how to make a budget that will work for your family and be reasonable and achievable. I want to show you the value of having a family budget because it has worked in my family, and I know it will work in yours as well.

Answer

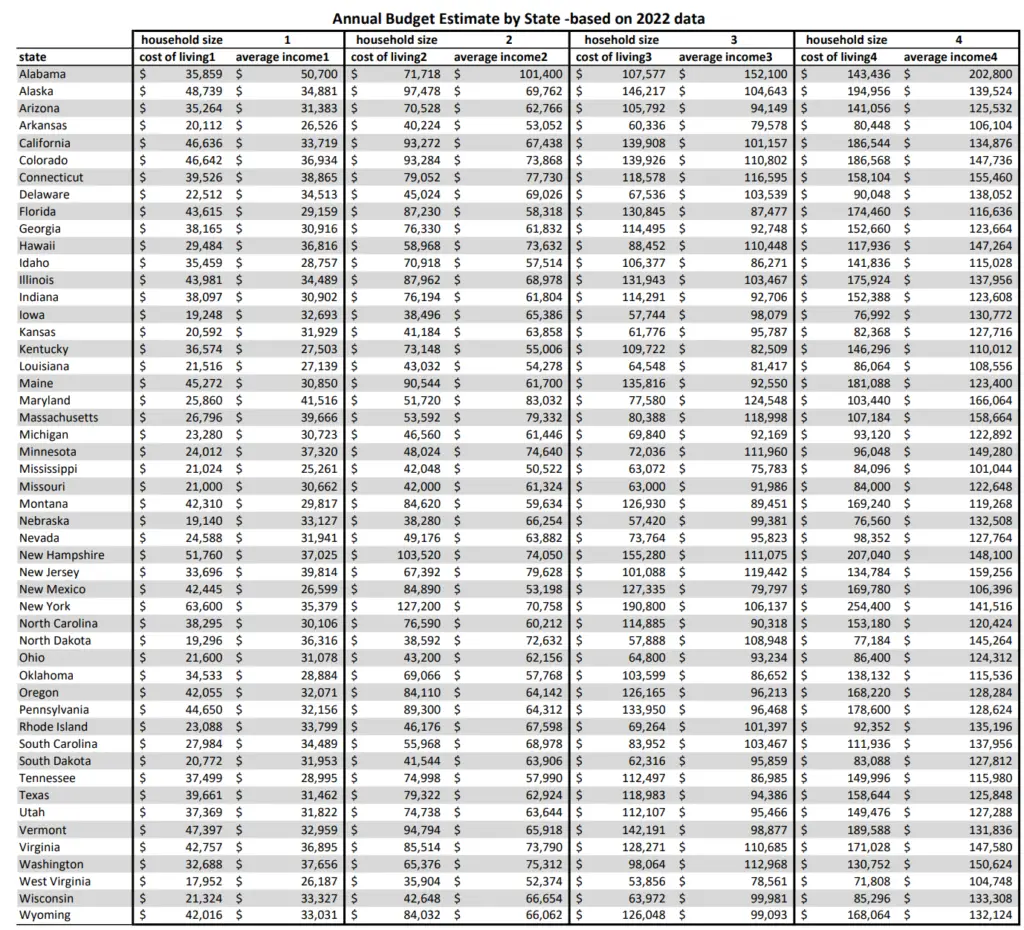

For a typical American family, the average cost of running a household for a family of 3 is about $6,600 monthly or $79,200 yearly. The average income comes to about $95,700 annually or about $7,900 monthly, based on the U.S. Bureau of Labor Statistics(2022). A reasonable family budget for the average American family size of 3 should be about $6,600 set aside for expenses and at least $7,000 in mutual income. Of course, this can fluctuate depending on what part of the country you live in and what your cost of living is for that area.

To better understand what kind of family budget you should set up, see the graph below, showing a comprehensive table of the state, the average cost of living, expenses per household size, and the average income for the area in 2021. These calculations are individual estimates multiplied by the number of people in a household.

Types of budgets:

- Percentage-based budgets:

- 50 30 20 budget: 50% take-home income towards necessities. 30% towards things not needed but usually 20% toward paying down debt and savings

- 70 20 10 budget: 70% of your income goes to bills and spending, 20% goes to saving and investing, and 10% goes to debt repayment or donation

- Surplus budget:

- This is when your income is higher than your expenses. In other words, when you work on your budget, you plan to have more income than expenses.

- Balanced budget:

- This is when you balance income and expenses, which means that you don’t plan for more or fewer income, called a surplus or deficit.

- A deficit budget:

- This means that the spending exceeds the income or, in other words, living in debt. Meaning your spending outweighs your gain. It is a good idea for a personal budget if you are investing for some time to grow your income which means you would be in deficit for a bit until your income picks up. But this is an exception.

- Incremental:

- This budget focuses on using real numbers from the prior month or year and then using that data to build a budget with a slight adjustment from the previous base information. Usually, the last year’s expenses increased in the current year’s calculation.

- Zero-based budget (Dave Ramsey method):

- A budget has a person allocate all of the money received to needs, wants, debt payments, and short and long-term savings or investments. In other words, at the end of each month, your income and expense should equate to zero.

- Strategic plan budget:

- This budget focuses on planning a budget for the long term that exceeds a year to funding for future vision and plans for the entity, creating a budget with a specific goal. You can use this budget in personal budgeting as well.

- Master budgeting:

- A master budget combines all the smaller budgets into one large budget that encompasses all other budgets into one focal point and gets evaluated on a monthly and quarterly cadence in a company. The master budget would be like the overall budget of a family that includes the husbands, wives, household, and kids’ budgets into a combination of information.

- Budget envelopes:

- A budgeting system that focuses on discretionary spending money that’s left over after necessities and fixed expenses like rent or mortgage. It utilized physical or digital envelopes to split cash expenses into categories.

Evaluation:

Evaluating which budget is suitable for you and which budget types work best in your family setting is essential. Look over the list of budgets above and see which budget sounds the most practical for your family. As long as you include most of these categories in your family budget expense, it would help if you had a better understanding of what your family budget amounts should be:

The categories can include:

- Groceries, rent, housing, household expenses, transportation, insurance, medical expenses, communications, financial expenses, and taxes.

- Housing: rent or mortgage, HOA dues

- Transportation: can include car payments, gas, car insurance, bus fare, uber, etc.

- Food – going out – restaurants and groceries should be categorized.

- Utilities – cable, internet, trash, water & sewers, electricity, gas, cell

- Insurance – could be included in transportation or left on its own if there is house insurance, car insurance, land insurance, etc.

- Medical & healthcare – co-pays, medication, child doctor visits, checkups, the unexpected

- Saving/ investing/ debt payment – adding a bit into each category will pay off in the long run.

- Personal spending/ extra family spending – cleaning supplies, toiletries, and other essential items

- Other house expenses – reports, lawn, house maintenance, home repairs, applicant replacement

Final steps:

After evaluating what budget fits your family’s needs, it’s essential to follow the steps needed to make the budget an everyday habit inside the family. Find the things that work for you, whether a whiteboard, a sheet of paper in a wallet, an app shared by all family members, or some other way to keep the family accountable for the process.

What budget system does my family use:

We have a combination of a few budget systems listed above. We use a surplus budget and the envelope cash budget system for the cash. If we have a surplus in our bank and physical cash, we can utilize that cash for future goals or savings as you would in a strategic plan budget.

Conclusion:

Setting a budget and starting the road to freedom can be a fantastic course. It is finding what works for your family and what a reasonable plan is essential for a budget to be achievable. Think through what budget types in the list above can be quickly followed and is exciting for your family. Let it become more of a game and not an obligation. So what’s stopping you from getting a budget together and working towards your family goals, whether it is getting out of debt, maintaining a balanced lifestyle, or saving for that future trip, college, fund, or hobby as a family? Budget limits are worth the effort upfront to see the best result in the future.

If you would like to read more about some creative ways to overcome economic recession check out the following post here.